The stock market rallied-a lot.....Cyclicals/heavy industrials are strong!!! Gold is going up.....Euro/USD is near the 50% retracement level from the lows of 1.17.....Oil is up.....How about copper??A bear reversal? If stocks were down......then everything would make sense given higher gold and bonds........given lower commodities!!!Stocks are up.......Be very cautious about this rally!!!!

Everything or Nothing on topics like Trading, Investing, Consulting , Gadgets,Movies,Songs and Women!!!Late at night........

Wednesday, 22 September 2010

Monday, 20 September 2010

Bulls vs Bears

AAII submits:Bullish sentiment, expectations that stock prices will rise over the next six months, rose 7.0 percentage points to 50.9% in the latest AAII Sentiment Survey . This is the highest level of optimism since August 13, 2009. The historical average is 39%. ~ Neutral sentiment, expectations that stock prices will remain essentially flat, rose 0.3 percentage points to 24.9%. The historical average is 31%. Neutral sentiment has been below its historical average for 10 out of the last 11 weeks

Sunday, 19 September 2010

Technology of the Future

Just a few thoughts from Google CEO Eric Schmidt:

- "The best applications are being built for mobile."

- "The smart phone is the defining, iconic device of our time."

- "Smart phone sales will eclipse PC sales in two years."

- "The web is the biggest platform of them all."

Saturday, 18 September 2010

1637-2009 List Of Bubbles

1. Tulip Mania

2. South Sea /Mississippi Company Bubbles

3. Railway Mania

4. Florida Speculative Building Mania

5. Roaring 1920s/1929

6. Poseidon Bubble

7. Gold

8. Japanese Asset Bubble

9. Dot Com/Tech/Telecoms

10. Global Real Estate/Credit Bubble

11. China/Shanghai Index Stock Bubble

12. Commodity Bubble

13. Oil Bubble

14. Leverage/Derivative/Financial Bubble

2. South Sea /Mississippi Company Bubbles

3. Railway Mania

4. Florida Speculative Building Mania

5. Roaring 1920s/1929

6. Poseidon Bubble

7. Gold

8. Japanese Asset Bubble

9. Dot Com/Tech/Telecoms

10. Global Real Estate/Credit Bubble

11. China/Shanghai Index Stock Bubble

12. Commodity Bubble

13. Oil Bubble

14. Leverage/Derivative/Financial Bubble

Friday, 17 September 2010

Gold Prices Scored Again. Will The Rally Persist?

Strong investment demand overpowered the diminishing jewelry demand and sent gold prices to another record high yesterday.

Gold prices saw $1,279.50 per ounce as global economic worries sent the investors to the safe haven. Silver reached a new high as well, approaching $21 an ounce. The falling US dollar is helping the metal prices as well.

Gold is heading toward the $1,300 to $1,350 price target, most analysts expect. Some, however, are skeptical about the strength of the rally.

Will the rally persist?

Technically, it is too early to say, but the spot prices were supported at just below $1,270, in the range of the previous high. An old high works as a strong support when prices crossover with good volume and hold ground.

Fundamentally, the global expansionary monetary policies work as a strong support for prices. The precious metal is becoming the currency and a reserve asset.

The Federal Reserve decision to reduce interest rates to stimulate the economy reduces costs of owning bullion and gold stocks. Interest rates will likely stay low considering the slow economic growth.

said Robin Bhar, analyst at Credit Agricole.

Pointing to a report of dwindling physical demand, the Austrian Mint reported a drop in sales in the twelve-month period that ended in August, says Jon Nadler senior analyst at Kitco in his daily commentary, cautioning novice investors “not everything you read on bullion bully bullish gold websites is true”. He recommends 10% gold allocation in a portfolio.

George Soros, billionaire financier, gave his version of warning as well. Talking to Reuters, he cautioned traders of the gold securities and said that gold is "the ultimate bubble … it's certainly not safe and it's not going to last forever."

Soros' advice has a lot of weight but gold’s rally might be far from finished, as fundamentals remain strong. The Fed decision next week will be crucial for gold prices. Announcement of quantitative easing, a.k.a. printing money, may ignite another rally.

Gold: Good Investment in Inflation and Deflation?

Investors usually back off and say "wait a minute, that can't be" when an analyst or strategist says that gold is the investment of choice both in periods of inflation and in periods of deflation, or dismiss them as being "gold bugs". Yet that is exactly what history suggests following the extended periods of recovery after past global financial crises.

Similar to a study by Rogoff and Reinhart of past financial crises, Carmen and Vincent Reinhart (After the Fall, August 2010) observe that the post-crisis unwinding of a characteristically long build-up in excess credit in the decade before such crises is a serious impediment to GDP growth and employment for ten years following the crisis. In other words, the debt unwind is a slow, agonizingly long process. Because this process takes so long, the mistake that policy makers repeatedly make is to assume the after-effects of the crisis are temporary, where as the subsequent slow growth is long-term, and can be exacerbated by timid policies that neither support fiscal spending nor deal with the capital-adequacy problems of key financial institutions.

In After the Fall, the Reinharts cover 15 episodes of financial crises, including three global episodes—the 1930s Great Depression, the 1973 Oil Shocks and the 2007 Subprime Crisis, as well as Japan’s 1992 crisis. Everyone is aware that stock prices plunged during these crises, but what happened to other financial markets during the same period?

Similar to a study by Rogoff and Reinhart of past financial crises, Carmen and Vincent Reinhart (After the Fall, August 2010) observe that the post-crisis unwinding of a characteristically long build-up in excess credit in the decade before such crises is a serious impediment to GDP growth and employment for ten years following the crisis. In other words, the debt unwind is a slow, agonizingly long process. Because this process takes so long, the mistake that policy makers repeatedly make is to assume the after-effects of the crisis are temporary, where as the subsequent slow growth is long-term, and can be exacerbated by timid policies that neither support fiscal spending nor deal with the capital-adequacy problems of key financial institutions.

In After the Fall, the Reinharts cover 15 episodes of financial crises, including three global episodes—the 1930s Great Depression, the 1973 Oil Shocks and the 2007 Subprime Crisis, as well as Japan’s 1992 crisis. Everyone is aware that stock prices plunged during these crises, but what happened to other financial markets during the same period?

The Great Depression

click to enlarge

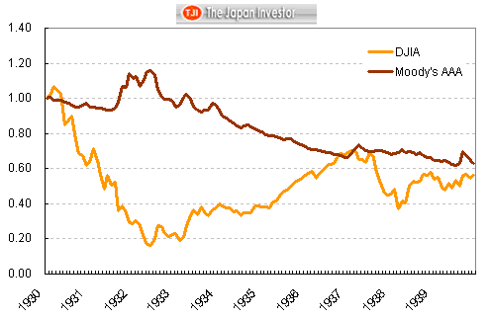

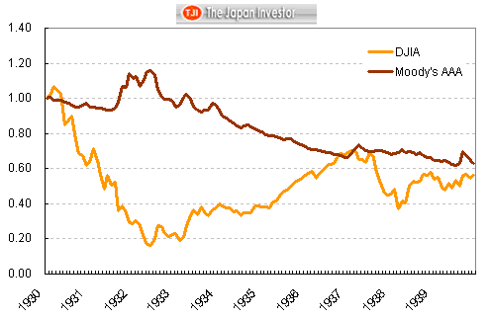

Source: Yahoo.com. Jan. 1930 = 1.00

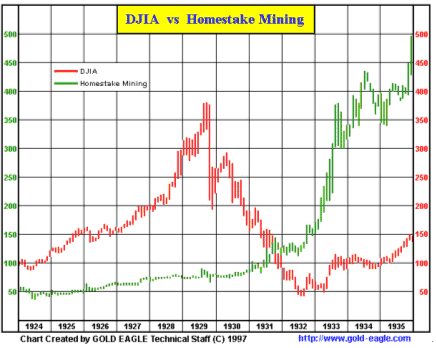

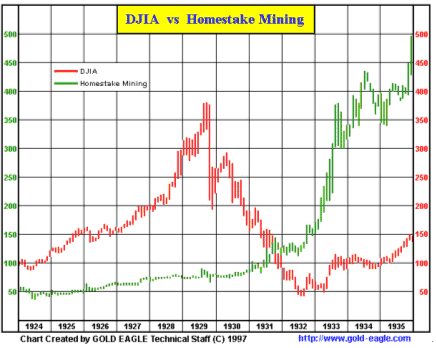

Source: Gold-Eagle.com

As the above charts show, interest rates as measured by the coupon on Moody's AAA corporate bonds declined during the entire decade following the Crash of '29, as the period was characterized by strong debt deflation. On the other hand, using the stock price of Homestead Mining as a proxy for gold prices during the period, gold prices not only sold, they went ballistic, rising five-fold during the 1930 to 1939 period.

The 1970s Oil Shocks

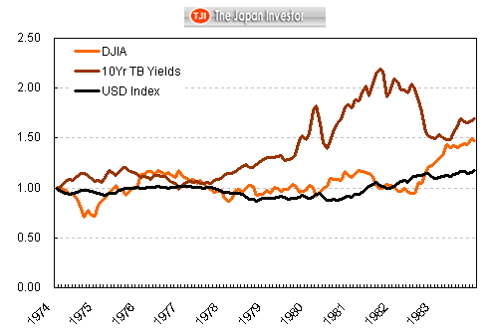

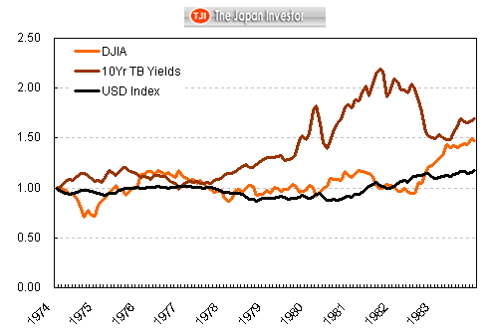

Sources: Yahoo.com, St. Louis Federal Reserve

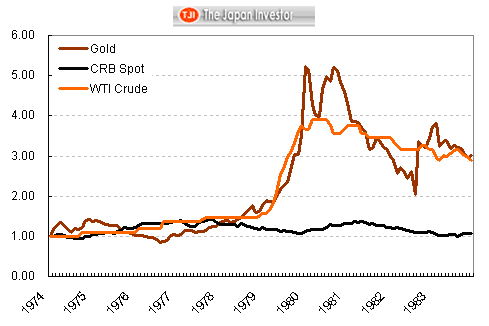

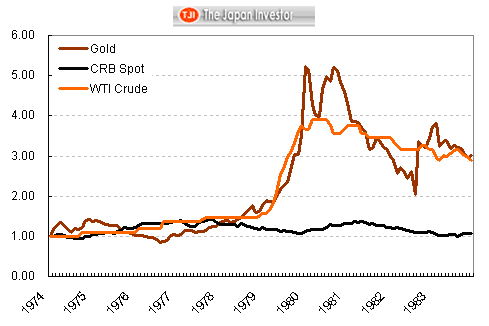

Sources: Yahoo.com, World Gold Council

In the decade after the 1973 oil shock, bond yields surged to around 1982 because of the virulent inflation unleashed by the exogenous shock to prices throughout the global economy because of the sudden interruption of crude oil supplies. Stock prices, particularly in real, inflation-adjusted terms, saw one of the worst bear markets in history, but revived and staged a strong rally as soon as bond yields began falling. On the other hand, gold prices were surging during the peak of inflationary pressures during this period, again by about 500%.

From the historical experience of these two global financial crises, those who claim gold rises both in periods of deflation and inflation are historically correct. But the major caveat is after a major financial crisis. The strong inference of course is that the real driver of gold prices during these periods was not inflation or deflation per se, but the rapid increase in government debt that debased fiat currencies and spooked investors into a strong risk-aversion mode. In other words, when it looks like the world's economy and financial markets are going to hell in a hand basket, your first choice should be to go long gold, and then worry about whether it's inflation or deflation that is the problem.

Source: Yahoo.com. Jan. 1930 = 1.00

Source: Gold-Eagle.com

As the above charts show, interest rates as measured by the coupon on Moody's AAA corporate bonds declined during the entire decade following the Crash of '29, as the period was characterized by strong debt deflation. On the other hand, using the stock price of Homestead Mining as a proxy for gold prices during the period, gold prices not only sold, they went ballistic, rising five-fold during the 1930 to 1939 period.

The 1970s Oil Shocks

Sources: Yahoo.com, St. Louis Federal Reserve

Sources: Yahoo.com, World Gold Council

In the decade after the 1973 oil shock, bond yields surged to around 1982 because of the virulent inflation unleashed by the exogenous shock to prices throughout the global economy because of the sudden interruption of crude oil supplies. Stock prices, particularly in real, inflation-adjusted terms, saw one of the worst bear markets in history, but revived and staged a strong rally as soon as bond yields began falling. On the other hand, gold prices were surging during the peak of inflationary pressures during this period, again by about 500%.

From the historical experience of these two global financial crises, those who claim gold rises both in periods of deflation and inflation are historically correct. But the major caveat is after a major financial crisis. The strong inference of course is that the real driver of gold prices during these periods was not inflation or deflation per se, but the rapid increase in government debt that debased fiat currencies and spooked investors into a strong risk-aversion mode. In other words, when it looks like the world's economy and financial markets are going to hell in a hand basket, your first choice should be to go long gold, and then worry about whether it's inflation or deflation that is the problem.

Subscribe to:

Comments (Atom)